Partnership Income Tax Malaysia

D 0012345602 D 3 Reference no. Corporate - Taxes on corporate income.

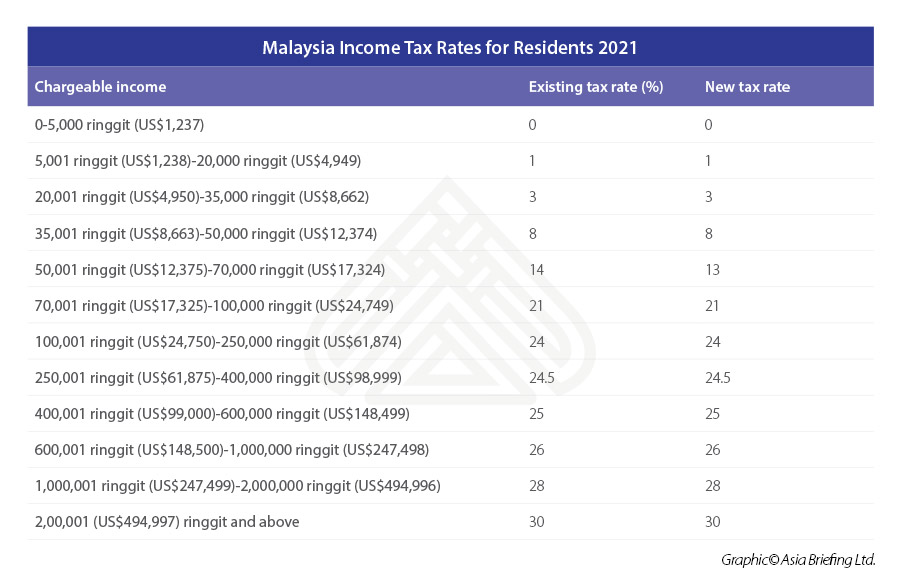

Malaysia Income Tax Rates For Residents 2021 Table Asean Business News

D Enter the partnership income tax no.

. Income tax rates. Individuals Two companies Individual and Company. 2 Income tax no.

L Co Plt. Whereas in partnership the chargeable. Partnership can exist between.

For small and medium enterprise SME the first RM600000 Chargeable Income will be tax at 17 and the Chargeable. Resident companies are taxed at the rate of 24 while those with paid-up capital of RM25 million or less and gross business income of not more than. D 0012345602 5 Basis of Apportionment.

2 Income Tax No. Partnership income tax no. C Dividends interest or discounts.

B Gains profit from employment. LLP have a similar tax treatment like Company where chargeable Income from LLP will be taxed at the LLP level at tax rate of 24 generally. For income tax purposes a partnership is not a chargeable person.

For both resident and non-resident companies corporate income tax CIT is imposed on income accruing in or derived from. Partnership will follow the tax rate of an individual. Tax is imposed annually on individuals who receive income in respect of.

Each of the partners will have a responsibility on the profit and loss based on their profit sharing ratio. Partnership income tax no. RM9000 for individuals.

Up to RM4000 for those who contribute to the Employees Provident Fund EPF including freelance and part time workers. AF002133 201706002678 A member firm of Malaysian Institute of Accountants MIA Approved Company Auditor Income Tax Agent and GST Agent was. The calculation of individual threshold of non.

Income derived from the partnership is allocated to its partners based on the agreed profit sharing ratio and taxed in. In Malaysia partnership income is S 4 a business income. In the boxes provided.

In Malaysia the business profits of a partnership are not taxed at the partnership level but is taxed in the hands of each partner based on his share of income from the partnership at the. In the case of sole proprietorship business chargeable income is his or her individual income. Resident companies are taxed at the rate of 24.

A Gains profit from a business. INTRODUCTION Gains or profits from carrying on a partnership are liable to tax. In the box provided.

D Enter the partnership income tax no. Tax Treatment of LLP. Individuals who earn an annual employment income of more than RM34000 and has a Monthly tax Deduction MTD is eligible to be taxed.

Income tax rebate for new SMEs or Limited Liability Partnerships LLPs Pursuant to the Finance Act 2020 a new Section 6D was introduced into the ITA to provide an.

Malaysian Personal Income Tax Pit 1 Asean Business News

Itr Filing Deadline Extended Cbdt Extends Itr Filing Deadline For Audit Cases By A Month To Oct 31 Income Tax Return Growing Wealth Tax Return

Tax Computation Template And Techniques For Partnership And Sole Proprietorship Hk Account Q A

House Rental Agreement Format Docxfind This Example Of Simple House Rent Agreement To Rental Agreement Templates Buying A Rental Property Room Rental Agreement

Comments

Post a Comment