Which of the Following Statements Regarding Inventory Accounting Is False

The cost flow assumption need not correspond to the actual physical flow of goods. Up to 20 cash back Which of the following statements is false regarding inventory costing methods.

Solved Which Of The Following Statements Regarding Inventory Chegg Com

20 November 2021 by lets tokmak.

/GettyImages-980921586-5c40753184574096baeecae2213ff41e.jpg)

. Accounting is the information system that measures business activities processes that information into reports and communicates the results to decision makers. B Vendor allowances should be used by the buyer to lower the cost of inventory and the cost of goods sold. Which of the following statements regarding shrinkage is not true.

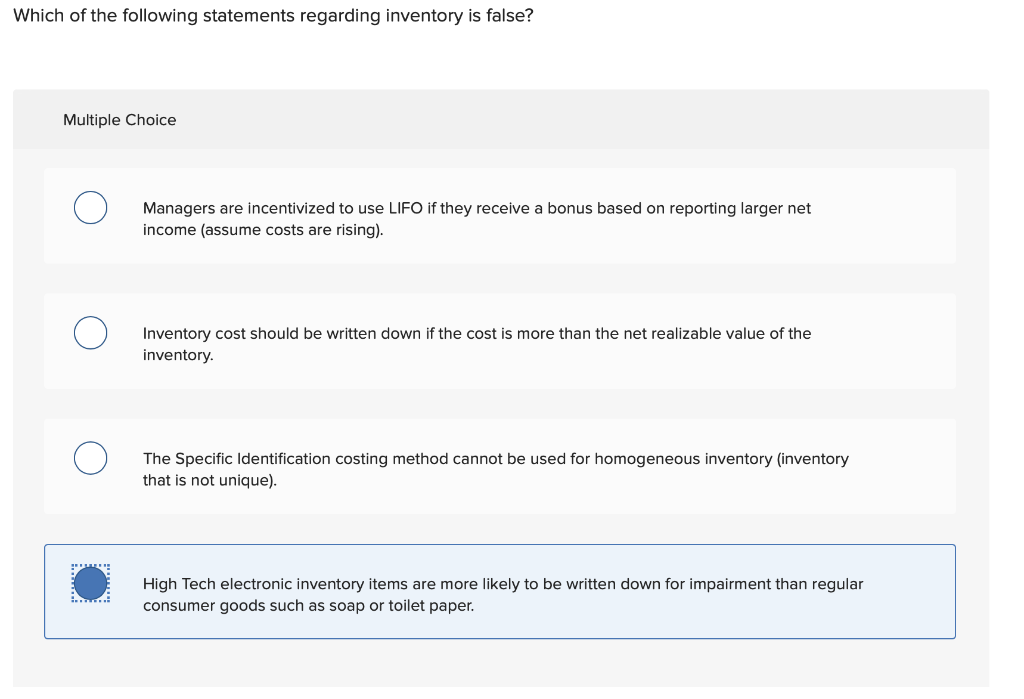

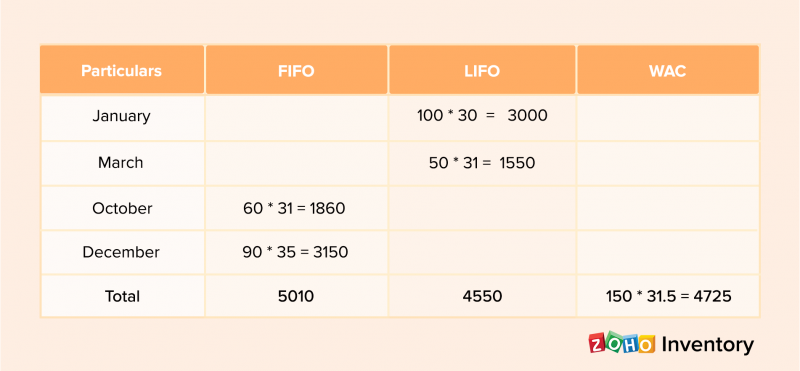

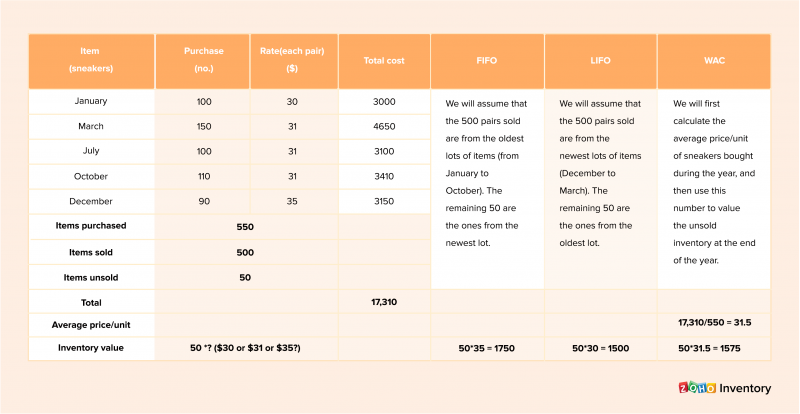

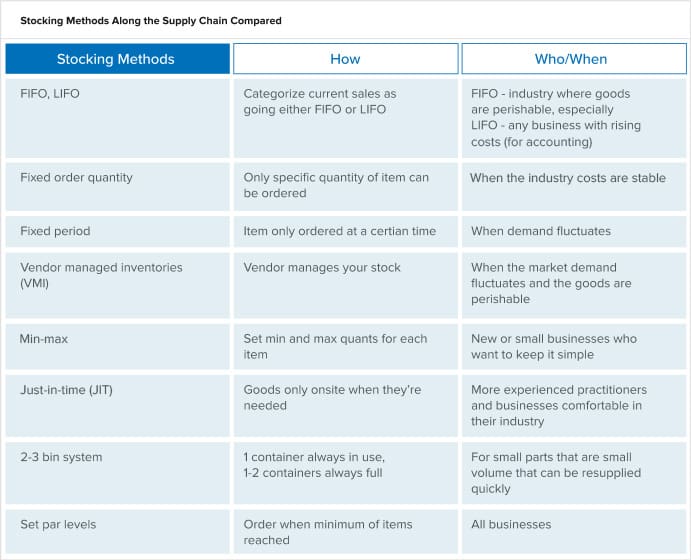

Which of the following statements regarding inventory accounting is false. Which of the following statements regarding inventory accounting is false. Firms that use LIFO must disclose the dollar magnitude of.

CMerchandise inventory may include the cost of freight-in and making them ready for sale. Merchandise inventory may include the costs of freight in and making them ready for sale. Merchandise inventory refers to products a company owns and intends to sell.

Accounting records are continually updated in a periodic inventory system. O Firms that use LIFO must disclose the dollar magnitude of the difference between LIFO and FIFO cost. A IFRS requires the use of absorption costing.

Which of the following statements regarding inventory accounting systems is true. The application of PFRSs with additional disclosures when necessary is presumed to result in financial statements that achieve fair presentation II. A A cash purchase discount that is lost due to a late payment should be recorded as interest expense rather than a cost of acquiring inventory.

Which of the following statements regarding inventory accounting is true. Multiple choice ifrs permits inventory reductions due to lower of cost or market writedowns to be reversed if the market recovers. Which of the following statements regarding inventory accounting is false.

GAAP and IFRS apply lower of cost or market in the same manner when accounting for inventory. Multiple Choice In the US FASB prefers replacement cost accounting because it records holding gains on the financial statements as they arise. GAAP prescribes a standardized format for disclosing the LIFO reserve.

C inventory does not have to be counted. 94 Which of the following statements regarding inventory accounting is false. When in the beginning any inventory method like FIFO LIFO and Weighted average method can be used.

Which of the following statements regarding inventory accounting is false. Multiple Choice To avoid providing an incentive for managers to engage in intentional LIFO liquidations bonus contracts should subtract out any profits from LIFO liquidations The size of the difference between cost of goods sold under FIFO and cost of goods sold under. Which of the following statements regarding inventory accounting is false.

Owners of a corporation are personally liable for the debts of the corporation. A periodic inventory system is less costly than a perpetual. The formula to convert the cost of goods sold under LIFO to an estimate of the cost of goods sold under FIFO is.

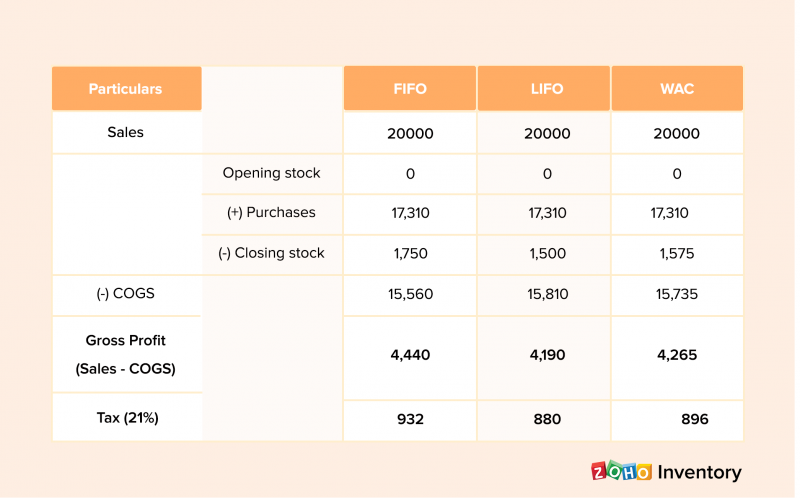

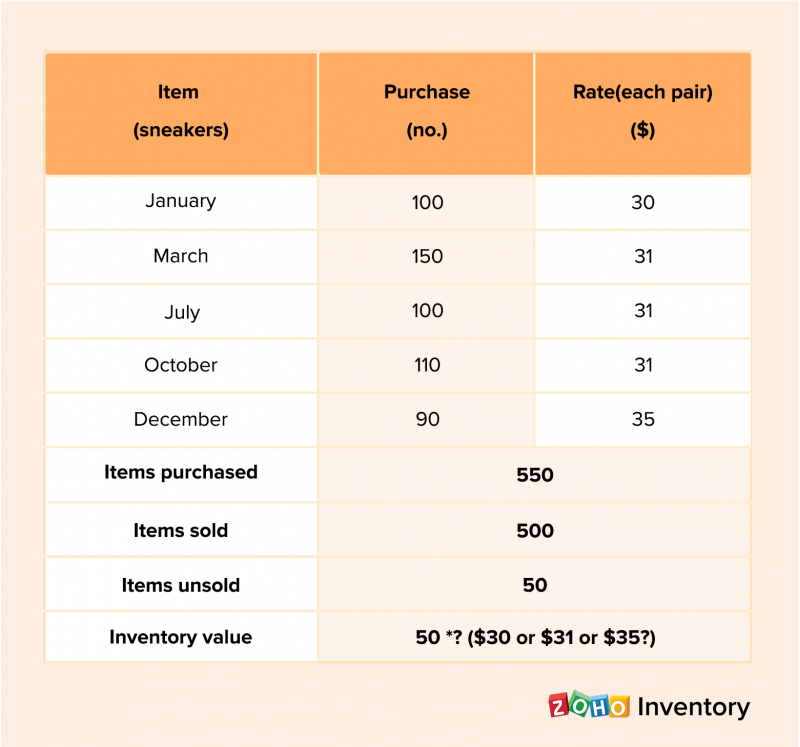

The cost flow assumption need not correspond to the actual physical flow of goods. The assumption regarding the change of inventory method is false as per each accounting period. Multiple Choice To get the most recent prices into cost of goods sold a company using LIFO will use the periodic inventory system rather than a perpetual system to compute its ending inventory and cost of goods sold.

GAAP prescribes a standardized format for disclosing the LIFO reserve. Multiple Choice The FIFO method of inventory valuation assumes that the first unit purchased is the first unit sold. Multiple Choice O US.

Which of the following statements regarding inventory accounting is false. The assumption selected may be changed each accounting period. Which of the following statements regarding fair presentation and compliance with generally accepted accounting principles is false.

If a company uses a perpetual inventory system and the inventory count at the end of the accounting period is greater than the balance in the inventory ledger account there must have been shrinkage. Which of the following statements is false regarding an assumption of inventory cost flow. GAAP current cost replacement cost accounting may be used at the discretion of management with proper disclosure.

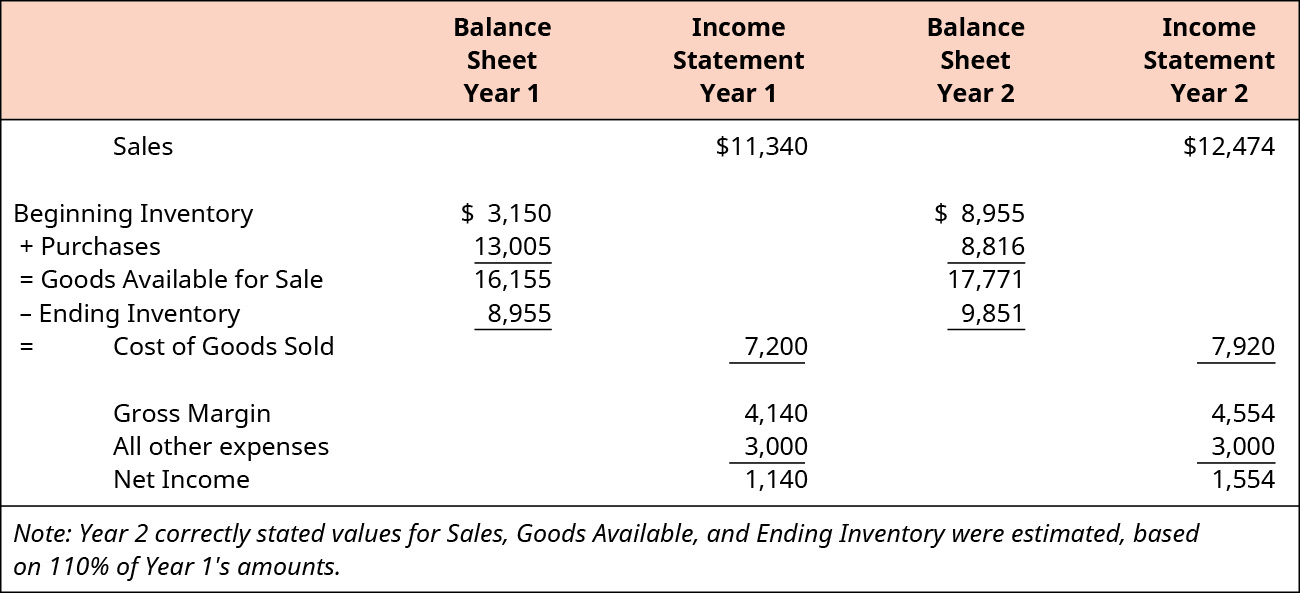

Which of the following statements regarding inventory accounting is false. The primary difference between FIFO and LIFO is that each method makes a different choice regarding which financial statement element is shown at the out- of. It can be taken from the accounting records A company starts the period with 100 computers in inventory purchases 30 more returns 4 of them to suppliers and has 83 in inventory at the end of the period.

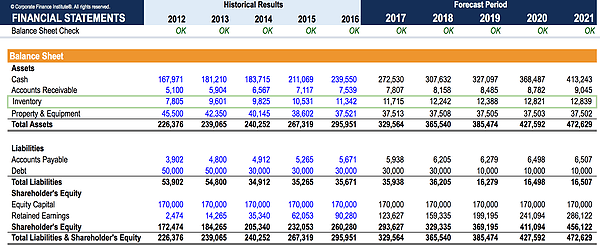

AMerchandise inventory is reported on the balance sheet as a current asset bMerchandise inventory refers to products a company owns and intends to sell. The size of the difference between cost of goods sold under FIFO and cost of goods sold under replacement. A disadvantage of the perpetual inventory system is that the inventory dollar amounts used for interim reporting purposes are estimated amounts.

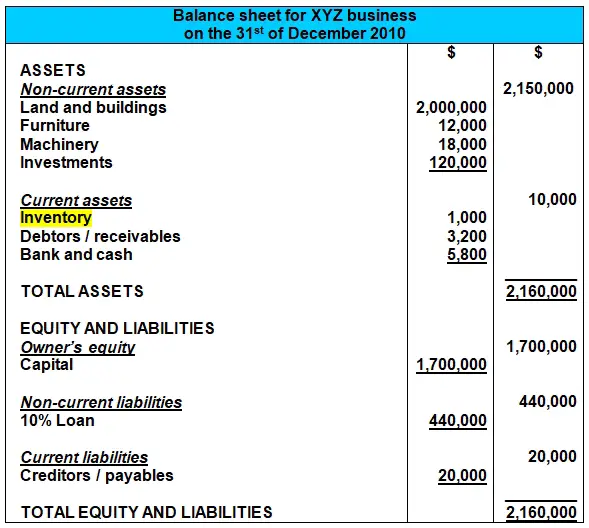

Merchandise inventory is reported on the balance sheet as a current asset. O The formula to convert the. The LIFO assumption uses the earliest acquired prices to cost the items sold during a period.

When purchases and sales occur continuously the costs. The following statements regarding merchandise inventory are true except. If inventory quantities are to be maintained part of the earnings must be invested plowed back in inventories when.

The weighted average cost flow. 87 Which of the following statements regarding inventory accounting is false. Ifrs requires the use of absorption costing.

Which of the following statements regarding inventory accounting is false. Which of the following statements regarding inventory systems is false. Which of the following statements regarding merchandise inventory is not true.

Financial statements report financial information about a business entity to decision maker C. Which of the following statements regarding inventory counts is not true. Cost of goods sold is calculated at each sale of inventory in a perpetual system.

The fifo assumption uses the earliest acquired prices to cost the items sold during a period. The size of the difference between cost of goods sold. Which of the following statements regarding inventory accounting is false.

C IFRS permits inventory reductions due to lower of cost or market writedowns to be reversed if the market recovers. GAAP prescribes a standardized format for disclosing the LIFO reserve. B inventory must be counted at the end of each accounting period.

Cost of goods sold is calculated at the end of the period only in a periodic system. Which of the following statements is false regarding an assumption of inventory cost flow.

Financial Statement Notes Example Everything You Need To Know About Financial Statement Note Financial Statement Personal Financial Statement Financial

What Is Inventory Valuation Importance Methods And Examples

Inventory Raw Materials Work In Progress And Finished Goods

What Is Inventory Valuation Importance Methods And Examples

What Is Inventory Valuation Importance Methods And Examples

Explain And Demonstrate The Impact Of Inventory Valuation Errors On The Income Statement And Balance Sheet Principles Of Accounting Volume 1 Financial Accounting

What Is Inventory Valuation Importance Methods And Examples

Inventory Control Defined Best Practices Systems Management Netsuite

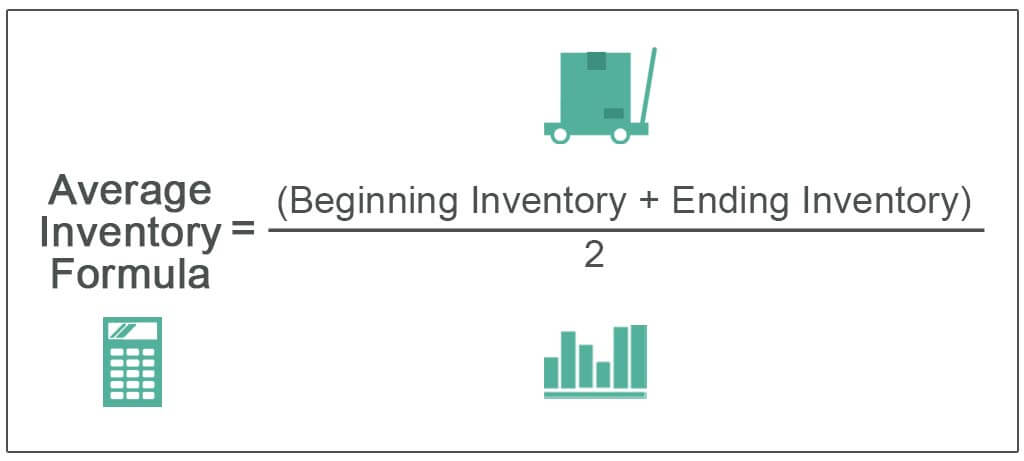

Average Inventory Formula How To Calculate With Examples

Inventory Raw Materials Work In Progress And Finished Goods

Raw Materials Inventory Definition Formula And Turnover

How To Disable Vsphere Web Client Inactivity Timeout Disability Clients Helpful

Acc 560 Wk 3 Quiz 2 All Possible Questions Quiz Questions Acc

Pin By Victor Mutua Muia On Academics Operations Management Scientific Management Knowledge Society

Comments

Post a Comment